I’m sure many of you have made New Year’s Resolutions, am I right? How is that going? Have you stuck with your resolutions, or did they only last a short period of time? While many people have great intentions when deciding on the resolutions they will make into the new year, many people do not stick with them for longer than a few weeks to a month. One resolution that many people make every year is to get on track with their spending, and start saving money, or get out of debt.

Let’s not call it a resolution, but a goal. Does that sound okay to you? I feel like a goal is something to really strive to reach and we might stay a little more focused. So, here are some tips to reaching your goal of saving money and becoming debt free.

1.) Start by jotting down exactly what you want to achieve. Do you have credit card or student loan debt that you would like to pay off? Ok, that’s where you start. We must first set the goal that we want to achieve .

2.) Step 2 is to make a list of all expenses (everything big and small) that you pay on a monthly basis. It is great to know exactly how much you already have going out every month. You’d be surprised at how many people don’t realize that their monthly payments actually exceed what they are bringing in, no wonder they are struggling.

3.) Now that you know how much you have going out each month, you need to figure how much you have coming in each month. Jot down all payments that the family members in the household receive each month (only those that will be contributing to monthly bills, of course).

Ok, now we know what our goal is, how much money we have going out and how much money we have coming in on a monthly basis.

4.) Budgeting: This is very important. Many people will frown when budgeting is mentioned, but if you want to get out of debt you are going to have to manage your money better. Not budgeting and not knowing exactly what was coming in and going out is probably what got you into this mess in the first place. Start by going back to the list you made with all of your monthly expense.

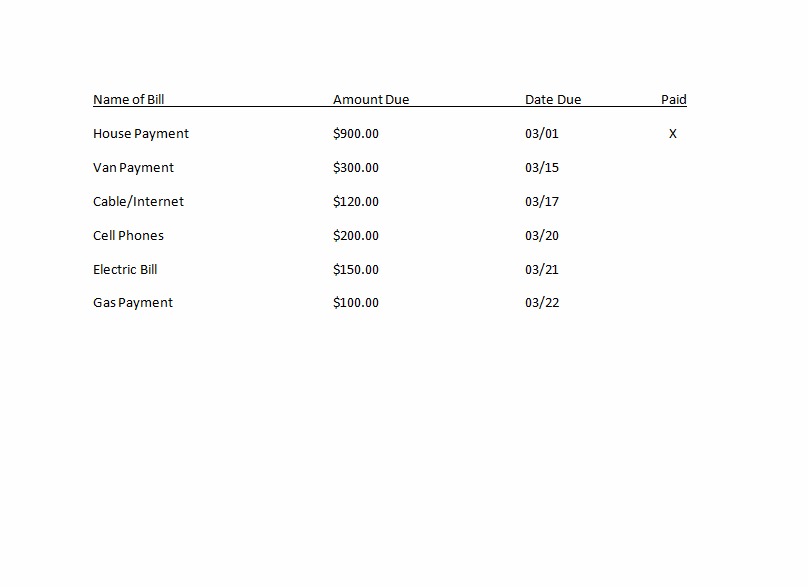

Below is an example of a very simple Bill Budget Sheet. This is a place for you to keep track of all bills that you need to pay, the dates they are due and then mark off when paid. You can get fancy and type it up or do it in Excel if you like, or you can hand write it each month.

The above numbers are just an example and were used to give you an idea of what a Budget sheet might look like.

The above numbers are just an example and were used to give you an idea of what a Budget sheet might look like.

Now that you are ready to budget you need to plan your “other” expenses.

5.) Planning “Other” Expenses: Give yourself a weekly or monthly allowance. If you get paid every two weeks, you may plan according to that, but whatever you do, sit down and figure how much money you are going to have left over after paying all of your bills. Some people include groceries in their monthly payments while others will include it in the “others”. Just be sure to include everything that needs to be paid somewhere in your budget. Figure out how much you will spend on things like Groceries, Gas, Coffee, Sitters (if you have one), Eating out and so forth. Now, this is the hard part…Cut Back! That’s right, and you might think to yourself, but where can I cut back? Start with something small, like eating out.

Below we are going to list some ways that you can cut your monthly expenses.

- Skip the restaurants and pack your lunch. Many times we are shoving leftovers into the back of our refrigerators, why not take advantage of those left overs?

- Skip the vending machines. These may not seem like they take up much money, but if you add what you are spending every day, over time it will definitely seem like a lot. Go the store and buy cookies or soda and bring it with you. It will save you a lot of money.

- Skip the coffee shop. If you are used to stopping for a $3-$5 coffee every day (and some pay more), don’t. That’s right, skip the coffee shop and make your own. Invest in a thermos or nice to-go coffee cup and bring your coffee with you.

- Lower Internet Fees. If you have a smartphone with the internet and also have internet at home you could get rid of the internet on your cell (or at home if you prefer to have it on your cell). This doesn’t have to be permanent, but could free up some cash while you work at paying down debt.

- Many people are getting rid of cable. Yikes, right? Not really, there are so many options these days for television that you won’t really be losing out. Try something like Netflix (which I believe is only around $8 a month), Roku Streaming Player (These can be purchased for about $60 at Target) which you can use to connect your television to the internet and then you can sign up for Hulu Plus and Netflix.

- Slash Cell Phone Bills: Did you know you can download the free Skype app for calling and the free WhatsApp for texting? You can use these through your phones data plan or a Wi-Fi network. This will allow you to switch to a less expensive cell phone plan, but you will still be able to text friends and family.

- Plan trips in one day. To save gas try to plan all of your trips in one day so you aren’t driving to town many different times. This seems like a simple step, but will definitely help save money.

We challenge you to give it a try for the next month and then come back and tell us how you are doing.

If you have money saving tips that you would like to add, we would love to hear them!

These are all great tips! I have also started to cut back on my spending and a budget is definitely a must!

Wow great post, love the ideas. I’m inspired to set up a saving goal plan. Thanks for sharing

Such a great post. I find that if I don’t keep very close check and write down what I spend, I very easily go over my budget without realizing it.